Beyond Hallman Chevrolet: How Dealership Fraud Abuses Lenders and Consumers

Recently, Hallman Chevrolet in Erie, Pa. was fined $2.1 million when it admitted to a fraud scheme that involved inflating the price of vehicles sold to subprime consumers. However, the issue of price inflation (one might call it “power booking” or “price gouging”) happens widely.

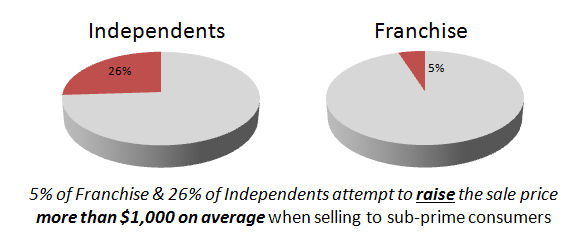

Attempts to inflate price at the time of sale by $1,000 or more happens frequently; on 14% of franchise sales and 24% of independent dealer used car sales to subprime consumers.

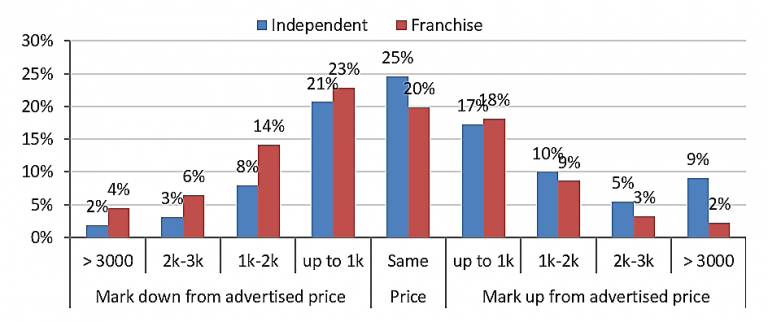

Indeed, the Hallman group is not alone. The following chart (shown at this year’s National Automotive Finance conference) perfectly describes the phenomenon. It shows how often and how severely dealers attempt to inflate sales price for subprime consumers.

The right half represents “price inflation”; the left half represents “sales at a discount” from the advertised price of a vehicle.

It’s not the end of the world. Most dealers still work very hard to give their customers a great experience and consistently complete used car sales with a discount from the vehicle’s advertised price. As the left half of the above chart shows, 24% of franchise sales and 13% of independent sales offer subprime consumers a discount of $1,000 or more from the advertised vehicle’s price.

Moreover, the chart above shows the phenomenon on a “per sale” basis, not “per dealership.” So how many dealers must we worry about in regards to price inflation?

On a per dealership basis, 5% of franchise and 26% of independent dealers attempt to inflate the price by over $1,000 on average when selling their vehicles to subprime consumers. It’s technically a minority of dealers but is still a very significant population.

The big question: “If there is no falsified down payment, is price inflation still fraud or is it just risky business?” If a consumer is unaware of the advertised price for a used car, does the dealer need to honor that price? Is a dealer allowed to pass on to the consumer the amount he expects to lose from his lender’s factoring policy? Should we leave this all for the courts to work out?

Regardless of legality, the price inflation practice is bad for lenders and consumers. Both lose! For the lender, it means hundreds of millions (if not billions) of added equity risk and deprecated collateral positions. For the consumer, it is an unnecessarily heavy financial burden for an already vulnerable payer.

What can we do about it? Historically banks often only check for inflated pricing (power booking) on a retroactive basis (after funding) when a loan defaults. This method is messy, expensive, and obsolete. To be proactive, we recommend implementing a policy of inspecting the advertised pricing on a dealer’s website – on a regular basis – before loan contracts come in. You might call this process “digital surveillance.”

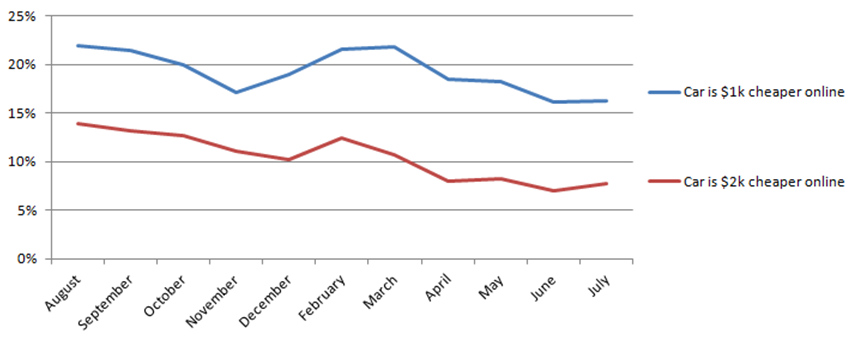

Some lenders are using our automated Playbook system to manage this process, and it works. The chart below shows attempts at price inflation by more than $2,000 have been cut in half since implementing! It’s been incredible to watch these process cause dealers to modify and improve their behavior over the last year.

We are excited to see the problem can be managed in an automated, scalable, and comprehensive way. If major lenders want to get this under control, I believe we could nearly eradicate the phenomenon in the next 12 months.

One of the reasons this approach is so powerful is it’s fraud-agnostic. We aren’t accusing dealers of fraud; this approach simply treats “price inflation” as suspicious behavior that needs to be corrected before loan funds and before it develops into a more significant problem.

General Forensics is proud to offer auto finance companies a one month free trial of this system. We work with lenders and banks, public and private, and can have you up and running in a few hours.

Thank you for reading. Please share your thoughts and feedback.

Josh Wortman is a data scientist at General Forensics.