Fraud Alert: Lenders can minimize risk of EPDs

Most early payment default cases, in which the borrower stops paying within the first six months, include fraudulent information on the loan application, making it crucial for lenders to identify misrepresentation prior to funding a loan.

There are several ways for auto lenders to preemptively identify loans that would likely default in the first six months, risk management platform Point Predictive Chief Fraud Analyst Frank McKenna told Auto Finance News.

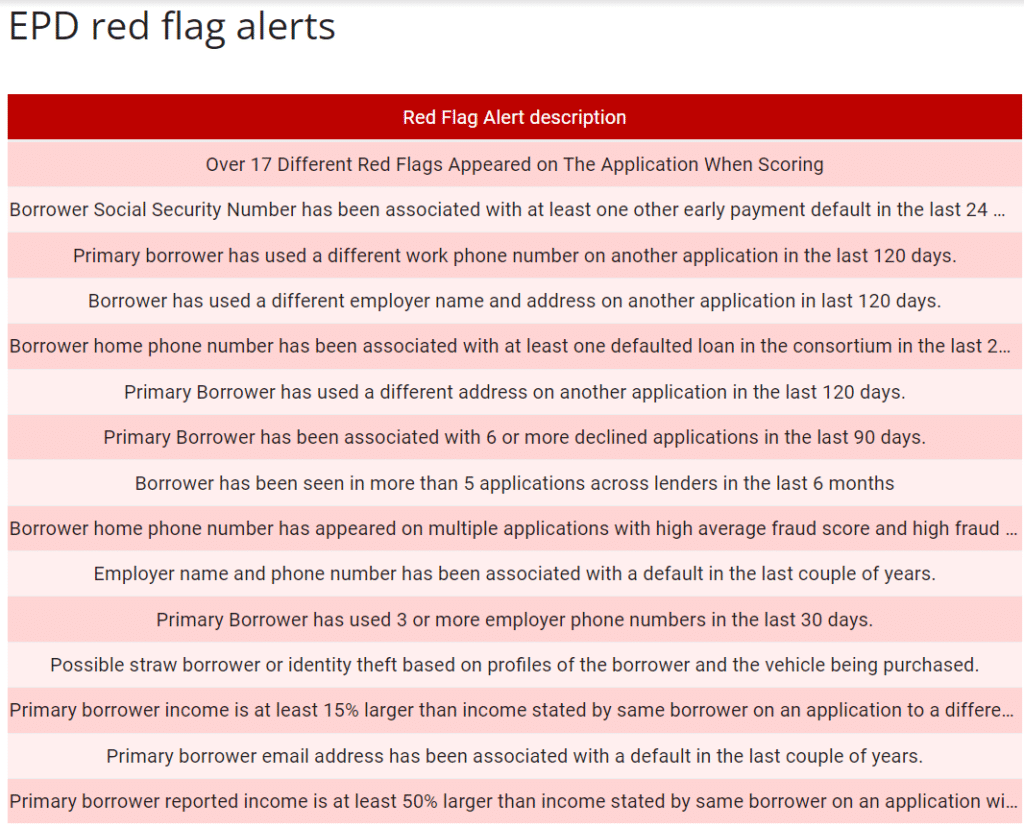

Loans with more than 17 potential indicators of false information on the application during the scoring process, for example, are eight times more likely to result in early payment default (EPD), McKenna said.

If a borrower was tied to another EPD case within the past two years, the risk of defaulting early again is eight times higher, he said. A different work phone number listed on multiple applications from the same primary borrower also is a strong indicator of likely EPD.

“There are a lot of alerts that lenders can pay attention to in order to avoid [EPD] from booking,” McKenna said, adding that when EPD occurs it is likely that red flag checks were not in place or that fraudsters were taking advantage of loopholes or “weak targets.”

Source: Point Predictive

Editor’s note: This story is the third in our series providing an in-depth look at trends in auto finance fraud in 2022.

The Big Wheels Auto Finance Data 2023 report, the only tabulation of the top 200 auto lenders by outstandings, is available now.