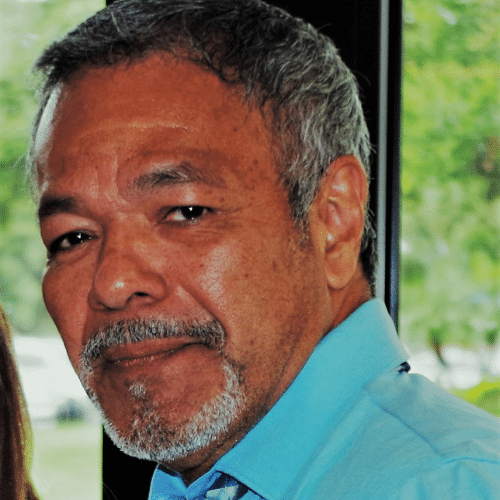

Five questions with … Platinum Auto Finance Director of Servicing Armando Hidalgo

Platinum Auto Finance’s Armando Hidalgo knows a few things about weathering storms, both in nature and in business.

As director of servicing for the Clearwater, Fla.-based subprime lender, Hidalgo helps serve auto consumers experiencing credit hardship, or who have no credit, by leveraging technology and data-driven analytics.

During the COVID-19 pandemic, servicing consumers meant lending a personal touch and identifying payment assistance programs they may qualify for, Hidalgo told Auto Finance News. “It’s a matter of trust,” he said.

Preparing for literal storms also helped Platinum during the pandemic. The lender turned to its hurricane preparedness plan in April 2020 to move employees to remote work setups within hours, Hidalgo previously said. Florida-based businesses must have plans for power outages, closed offices and potential evacuations. Hidalgo, who moved to Florida a few years ago, is pleased about the state’s recovery.

“In Florida, things opened up a little bit quicker,” Hidalgo said in May 2021. “We see a lot more people that were hit in the hospitality and the food and beverage industry. It’s our target market, subprime. [The subprime market] is recovering a little faster than what was predicted, which is a good thing to see.”

Hidalgo has more than 25 years’ experience in the auto finance space, having worked with Innovate Auto Finance for six years, and for more than seven years as the owner of Hidalgo and Associates. He joined Platinum in June 2018.

Hidalgo drives an 2011 Ford Edge SEL as it meets his personal and professional needs. “From room to haul stuff, and people, it fits all my needs,” he told AFN. “It looks sharp outside and inside with all the amenities for comfort and safety, with what now is considered ‘old school,’ a 6-cylinder under the hood that plants it firmly to the ground with a solid sound.”

Auto Finance Excellence asked Hidalgo five questions to learn about his thoughts on current lending trends, his goals for Platinum, and a surprising fact his colleagues may not know about him.

Auto Finance Excellence: What are your company goals in about 10 words or less?

Armando Hidalgo: Becoming 10 times better through learned and best practices.

AFE: What is your favorite piece of leadership advice you ever received?

AH: The Law of Influence. You have to put in the work. As my positions grew and leadership came with it, one of the things that I took with me for a long time was the laws of influence. It’s looking at [how to] influence the influencer.

With the teams, I would see who they would gravitate to and work with that person to get to know them. That allowed a segue into the full team. What I found is that you got a lot of positive responses and more buy-in into what people are doing.

One of the things I’ve always asked is, “How is it that you’re leading this group without a title?” And they say, “It’s because I listened to them. I work with them.”

It is not about a title or leadership position, and cannot be bought. With influence, you can rally people to a cause, move people in a new direction, and you can win people over in the long run.

AFE: Who has had the biggest influence on your career?

AH: John Maxwell. From my first seminar, “21 Irrefutable Laws of Leadership,” to his current “Change Your World” lessons, he has helped me develop, understand and serve as a leader.

My first interaction with John Maxwell was through a seminar in 2007. By that time, I had already gone into some entrepreneurial work. What really impacted me is the laws of leadership 21-week course. A quarter of the way in, John stopped and introduced himself.

When he introduced himself and told his life story, I had no idea that his teachings are all Christian-based. It all looks like business, but it’s not. When I was introduced to him, I thought it was business, but I saw something bigger, and it was more of a spiritual and religious experience. It gave me a different dynamic.

AFE: What do you think is the most underrated lending trend?

AH: The human interaction being lost in automation; the nuances lost in algorithms tend to not tell the whole story, causing missed opportunities.

You have somebody with good credit, but something happened. There was a furlough, pandemic happened. They can adjust the algorithm, but that is a blanket coverage and you’re going to be missing those little gaps, you’re going to miss out on opportunities.

Automation is great, but as we start going back, people eventually want to get back to face-to-face time.

AFE: What is something your employees would be surprised to learn about you?

AH: That I am an avid stargazer and big follower of space programs and companies, SpaceX being my biggest interest.