Alternative data key to risk-based pricing

Using alternative data supports accurate risk-based pricing for auto lenders and helps account for losses.

Some lenders continue to rely solely on credit scores, income and employment history, and debt-to-income ratios when decisioning loans, Kevin Filan, senior vice president of marketing with Open Lending, an automated lending service for auto financiers, told Auto Finance News. . However, lenders should also consider metrics such as vehicle values when considering loans, he said.

“If you don’t have that kind of eye on how the vehicle value is going to perform, you’re going to struggle with pricing for the risk,” Filan said.

For example, Hyundais and Hondas might be priced similarly, but will depreciate at a different rates, Filan said. Being able to predict when the payment default might occur allows lenders to assess how severe a default might be, he said.

If data shows payment default is predicted to occur 16 months into the loan term, for example, the predicted value of those two vehicles in month 16 is crucial in understanding the risk of offering that loan from the start, Filan said.

Roll rates increase in auto

Alternative data also allows lenders to curate a more detailed understanding of borrower behavior as inflationary pressures continue to weigh on consumers, Melinda Zabritski, senior director of automotive financial solutions at Experian, told AFN at Origence Lending Tech Live in San Diego last month.

The need for alternative data is especially useful during a time of elevated delinquencies and rising debt, Zabritski said.

“It might not look like [delinquencies] are super high, but this is essentially the levels of auto delinquency that we had back in 2009,” she said.

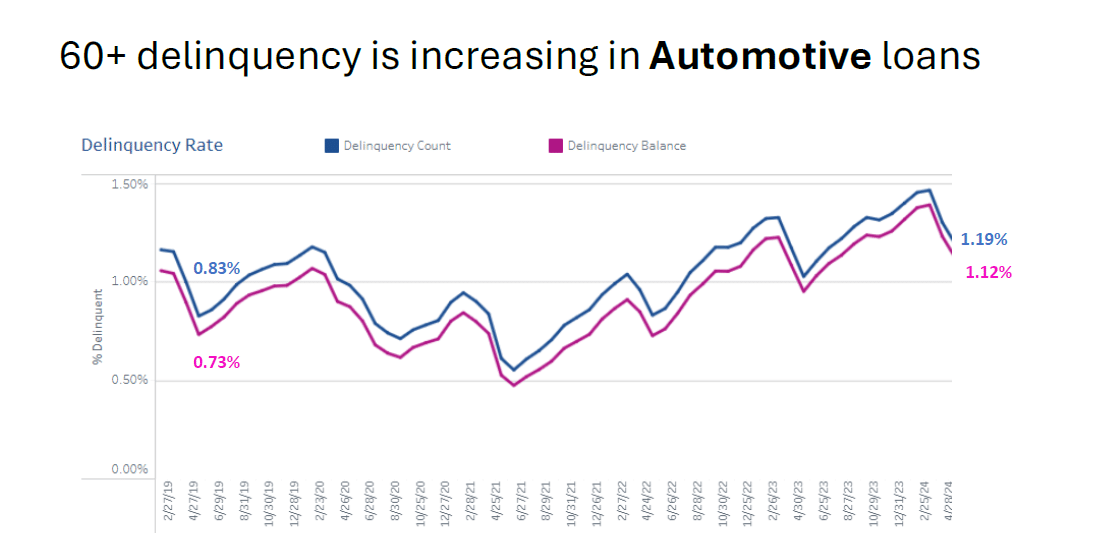

The 60-plus-day delinquency rate on auto loan balances was 1.12% in April compared with 0.73% in pre-pandemic April 2019, according to Experian data presented at the event. . Auto loan balances 60-plus days delinquent sat just under 1.5% in February.

The rate of consumers rolling to the next highest level of delinquency is climbing in the auto sector but stabilizing elsewhere, Zabritski said.

“We’re pretty much looking at the new [normal],” as vehicle values and loan amounts remain high, she said.

Other uses for alternative data and technology investments include accurately monitoring and storing vehicle value data and predicting the probability of prepay and default, Open Lending’s Filan said.

Lenders can avoid turning some borrowers away by using alternative data to offer near-prime borrowers a rate that they can afford while accurately measuring the risk of default, he said.

Auto Finance Summit, the premier industry event for auto lending and leasing, returns Oct. 7-9 at Wynn Las Vegas. . To learn more about the 2024 event and register, visit www. .AutoFinanceSummit.com.