GM Financial’s Berce reflects on legacy of culture, innovation

CEO retiring in April after 15 years at helm of captive

Dan Berce’s creation of a company culture that supports technological innovation, risk-based decision-making and long-standing tenure will remain core to GM Financial’s DNA long after he hands over the baton.

Berce, 71, has been president and chief executive of GM Financial since 2010, but his career in the auto finance industry spans decades, and his hand in helping shape the industry’s evolution is evident.

Dating to 1990, Berce held several leadership roles at AmeriCredit ahead of General Motors acquiring the company to form its captive finance arm in 2010. Berce will retire from GM Financial in late April, with Chief Financial Officer Susan Sheffield set to take the reins.

“I’d love for my legacy at AmeriCredit and GM Financial to be that I created a great culture and made it a place that people enjoyed coming to work every day.” — Dan Berce, GM Financial

“I’d love for my legacy at AmeriCredit and GM Financial to be that I created a great culture and made it a place that people enjoyed coming to work every day,” Berce told Auto Finance News. “That’s the highest praise that I can leave behind.”

Building a data-driven approach

Berce describes his experiences at AmeriCredit and GM Financial as different, given that when AmeriCredit was founded in 1992, it was strictly a subprime auto lender.

He was integral in the transition at AmeriCredit from an “approve or decline” binary decision process to a centralized decision-making approach that today is standard across the industry.

“If [a loan] was approved, everything was at the same price,” he said. “We saw the opportunity to number one, use data to drive that underwriting decision, and number two, to risk-base price.”

“We saw the opportunity to use data to drive that underwriting decision and to risk-base price.” — Dan Berce

AmeriCredit was “one of the first to pioneer a data-driven approach to underwriting,” Berce said. “Today there isn’t a company in auto finance that doesn’t use data and technology in building their underwriting models.”

Prioritizing dealer relations

AmeriCredit also held “significant” market share in the mid-to-late 1990s, setting the stage for third-party subprime financing at franchise dealers across the country, Berce said.

“We focused on dealer relationships; we had to earn the business as we weren’t a captive,” he said. “We weren’t, in many cases, the first choice for dealers to send the business to, so we developed a service-first, relationship-oriented business … [with] flexibility and accessibility of our people.”

That approach continues to breed success for GM Financial. The captive’s total penetration rate of U.S. General Motors sales was 39.2% in the fourth quarter of 2024, up 60 basis points year over year, according to the company’s Jan. 28 earnings presentation.

General Motors’ U.S. sales rose 4% YoY to 2.7 million vehicles in 2024, according to a Jan. 3 company report.

In recognition of GM Financial’s growth and ability to weather market fluctuations, drive employee retention and support dealer profitability, Auto Finance News honored Berce as Auto Finance Executive of the Year in 2023.

Becoming a captive

Berce led as GM Financial expanded outside of the U.S. and formed a global footprint.

“We also had product development that had to take place,” he said. “At AmeriCredit we were exclusively subprime, and we needed to expand to be a full-spectrum lender.

“We had to change our processes; subprime is a very hands-on, manual process and more transactional. To get into prime and super prime, we had to speed up our processes, automate and become more customer-relationship oriented.”

To be a successful captive, GM Financial also had to embrace new products such as floorplan financing and leasing, Berce said.

“It was a multi-year journey before we were ready to accept the mantle of being a full-fledged captive.” — Dan Berce

“We brought in some outside experts from other companies to help us, but it was a multi-year journey before we were ready to accept the mantle of being a full-fledged captive,” he said.

Today, GM Financial has grown to be one of the largest auto lenders in the country and was the third-largest by outstandings volume at yearend 2023, according to the latest Big Wheels Rankings data.

GM Financial’s originations increased 23% YoY in Q4 to $15.5 billion, while full-year 2024 originations ticked up 5.5% YoY to $56 billion. Loan and lease outstandings totaled $107.7 billion, up 4.3% YoY.

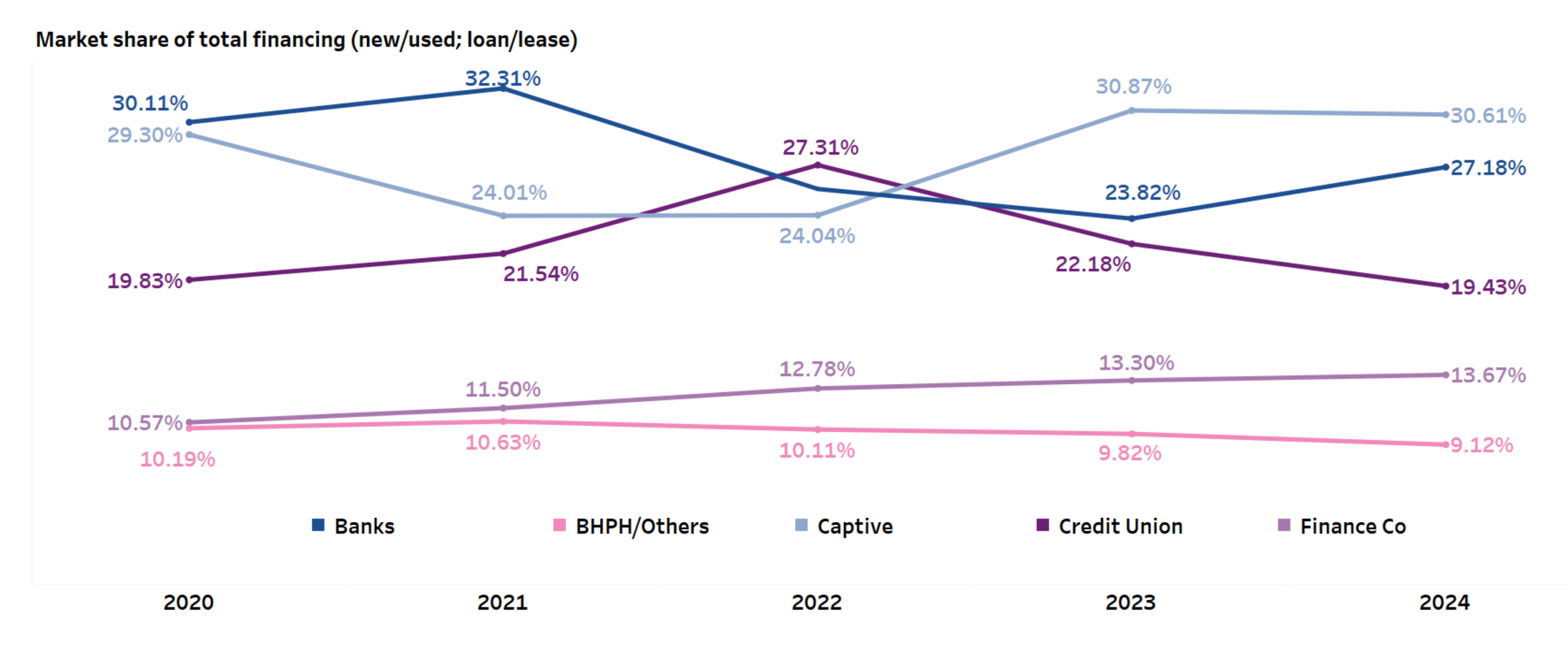

Captives held the largest share of total financing in Q4 at 30.6%, followed by banks at 27.2%, according to the latest data from Experian.

Q4 market share by lender type

Creating a lasting culture

While his impact on the company and industry is clear, Berce says his true legacy is the people. Several industry leaders who began at AmeriCredit have moved on to hold influential roles.

An AFN analysis of LinkedIn found that multiple people who once worked at AmeriCredit and GM Financial now hold leadership roles at large banks, including Ally Financial, JPMorgan Chase and Wells Fargo.

“The people part of our business was important from the get-go and establishing a great culture at AmeriCredit and now GM Financial was the cornerstone of our success.” — Dan Berce

“The people part of our business was important from the get-go and establishing a great culture at AmeriCredit and now GM Financial was the cornerstone of our success,” Berce said. “We have [strong] tenure, whether it’s at the leadership level or at the call center level.”

A testament to this is the average tenure at GM Financial: 8.4 years, with six out of 10 employees there for more than five years and 29% for 10 years or longer, according to company data provided to AFN.

At the leadership level, the average tenure of executive vice presidents is 14.9 years, according to the company. Since 2010, more than 600 employees globally have returned to GM Financial after leaving for other companies.

The culture of “agility, flexibility and empowerment” remained constant as AmeriCredit transitioned to GM Financial, Berce said.

“People bridged right through that AmeriCredit to GM Financial acquisition and didn’t skip a beat culture wise,” he said, noting that shared values kept employees around even as the company was bought out.

GM Financial’s ability to attract and retain talent throughout its journey is reflective of Berce’s commitment to establishing an enduring culture, Lane Borrello, senior vice president of corporate communications, told AFN.

“If you look at companies that go through a major transformation — whether it’s they get bought or ownership changes hands — there is almost always some sort of cultural decline,” she said. “That didn’t happen here.”

Passing the baton

Berce’s successor, Sheffield, has been with the company since 2001. She was named the captive’s executive vice president and treasurer in 2014, and appointed chief financial officer in 2018.

“I hired her into the company 24 years ago, and have watched her grow, first in our finance organization, then as CFO and now as CEO,” Berce said. “I have 100% confidence that she’s going to continue the great things we’re doing at GM Financial.”

Berce also commended Kyle Birch, president of North America operations, who has been at the company nearly 30 years, as well as President of International Operations Rafael Amoros, who joined GM Financial in 2013.

“We’ve got a tremendous leadership team with tenure,” Berce said. “We’re not going to skip a beat.”

Looking forward

Berce leaves in the hands of the new leadership team several long-term initiatives, including growing the footprint of GM Financial’s General Motors Insurance program and adding technology enhancements.

“You’re never done building and developing.” — Dan Berce

“You’re never done building and developing,” he said. “There are always things you can do to improve and grow the business.”

GM Financial is working to replace its legacy technology systems with more modern tech stacks, Berce said.

“[Updating] our front-end systems, our back-end systems, our enterprise systems like HR and finance — those are multiyear projects that I’m handing off to the leadership team,” he said. “We’ve got a lot of neat initiatives around AI that are multi-year in terms of implementation and development.”

Berce said he expects GM Financial to lean into AI and automation.

“The use of technology is accelerating and with the advent of tools like machine learning in the scorecard area, the availability of data, migration to the cloud and generative AI use in customer experience, things are changing rapidly,” he said. “I would expect the business to get more automated and more efficient.”

“I would expect the business to get more automated and more efficient.” — Dan Berce

GM Financial also reapplied in January to form the industrial bank GM Financial Bank, which, if approved by the Federal Deposit Insurance Corp., would offer auto lending and deposits to complement its core businesses.

As for Berce, he plans to keep in touch with the colleagues he also calls friends and to remain a guiding force in the industry.

“I’m sure they’re not going to call me every day, but I would hope that when they see things developing at GM Financial, they might reach out and ask what I think,” he said. “I’m willing to remain a resource as long as I can.”

Auto Finance Summit East 2025 is set for May 12-14 at the JW Marriott Nashville featuring fireside chats with Santander Consumer USA and Chase Auto. Visit autofinance.live for more information. Early-bird registration is available here.