In too deep: How affordability woes could sink subprime borrowers

If it costs more to put food on the table and keep a roof over your head, will you prioritize your car loan?

The most economically challenged borrowers in the U.S. are looking for a lifeline these days amid rising interest rates and inflation, and while many have yet to succumb to the pressures, affordability is a multifaceted problem, prompting auto lenders to keep a close eye on borrowers’ ability — and willingness — to make their car payments.

Subprime consumers have shown resiliency in the face of higher costs for the most basic needs such as groceries, gas, housing and insurance. Subprime borrowers, defined by the Consumer Financial Protection Bureau (CFPB) as having FICO credit scores between 580 and 619, historically have less disposable income and are at greater risk when economic conditions deteriorate.

Auto lenders who serve these consumers are watching carefully as rising delinquencies, elevated car prices and inflationary pressures exacerbate borrowers’ already tight purse strings. In fact, while these lenders aren’t yet describing the auto lending market as precarious, these concerns are weighing down consumers more than the industry realizes, Landon Starr, chief risk and information officer at Sandy, Utah-based subprime lender Arivo Acceptance, told Auto Finance News.

“I’m not ready to say that we’ve got unhealthy problems or concerns but, being brutally honest with ourselves, affordability continues to be this gigantic anchor on consumers,” he said. “It’s more prevalent than most people think. Interest rates are going to increase your payment on a month-to-month basis, but the parts of that we forget [are] insuring your auto, grocery costs, rent.”

Car insurance alone could destroy a budget. The average monthly cost of car insurance in the United States has ballooned by about 13.5% in the past year and a half, according to an Auto Finance News analysis of Bankrate data. Average full coverage cost is estimated at $168 per month in November 2023 compared with $148 per month in April 2022, when Bankrate’s True Cost of Auto Insurance Report 2022 was last published. Specific costs vary by state and are influenced by factors such as vehicle type and coverage policy.

“Affordability continues to be this gigantic anchor on consumers.” — Landon Starr, Chief Risk and Information Officer, Arivo Acceptance

Nonprime borrowers “are facing a high inflationary environment, the return of student loan payments, declining savings and flattening disposable income growth,” automation fintech Open Lending Chief Executive Keith Jezek said during the company’s Nov. 7 earnings call.

Student loan balances contributed to a $228 billion increase in household debt in the U.S. in the third quarter, bringing total debt to a record $17.3 trillion, according to the New York Fed’s quarterly household debt and credit report. And the core consumer price index, which excludes food and energy, remained at 4% in October, persistently above the Federal Reserve’s target of 2%. Not to mention, the average used-car payment in the third quarter was $567 per month, according to Edmunds.

The lack of affordability and auto lenders’ tightening risk appetite have contributed to a “historically low” share of subprime borrowers securing new-vehicle loans, Jonathan Gregory, senior manager of economic and industry insights at Cox Automotive, told AFN. The number of subprime borrowers is also shrinking as the pandemic-related stimulus allowed some consumers to climb into higher credit tiers, he said.

“Subprime buyers are on the sidelines right now,” Gregory said. “The hurdle we see in the foreseeable future is that most of the benefits that have buoyed subprime buyers have been taken away. Student loan repayment has begun again, credit card balances and interest rates are back to 2019 levels, and government checks have stopped.”

Beyond the rate

Subprime consumers are facing affordability challenges that go far beyond higher interest rates.

“Inflation and interest rate components, insurance costs: All of those different dynamics are culminating in a difficult environment for subprime consumers,” Arivo’s Starr said.

However, he added, “consumers have gotten resilient. Income is more versatile; side hustles are more easily accessible. Our society has created ways to supplement income through technology and the evolution of work that we’re seeing with the younger generation.”

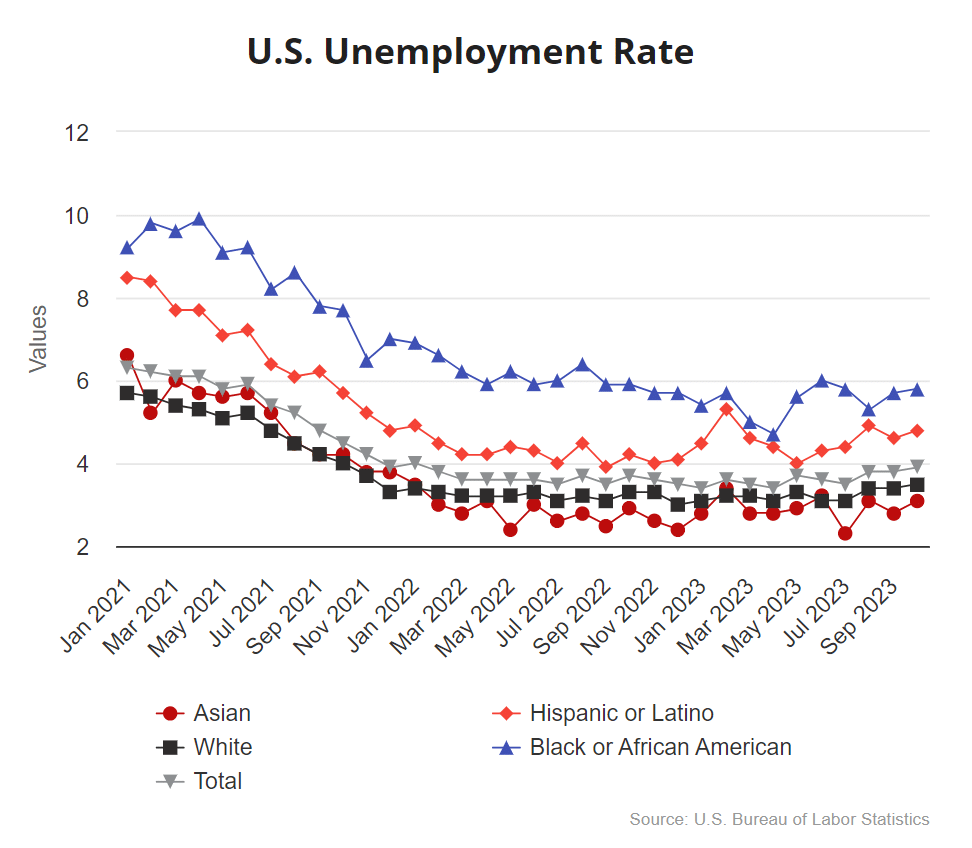

While the U.S. labor market has held up despite the Fed’s hawkish monetary policy — unemployment inched up to 3.9% in October largely due to manufacturing labor disputes — not all major worker groups fared equally. In fact, the unemployment rate for Black adults hit 5.8% in October and the unemployment rate for Hispanic adults landed at 4.8%, compared with 3.5% for white adults and 3.1% for Asian adults, according to the Bureau of Labor Statistics.

U.S. Unemployment Rate

Challenging market conditions have prompted even subprime auto lenders targeting low-income borrowers to tighten credit.

For example, Irving, Texas-based On the Road Lending, a nonprofit financier that provides auto loans to consumers with low FICO scores or little to no credit history, has increased its monthly income requirement to $1,800 from $1,500.

“That’s tight for many of our families,” President Lonnie Smith told AFN, adding that On the Road’s borrowers are primarily single mothers and people of color with FICO scores in the low 500s.

“The biggest piece for us continues to be affordability.” — Lonnie Smith, President, On the Road

On the Road’s average loan size in the past few years has grown by more than $10,000 to surpass $25,000 due to rising car prices and higher rates, he said.

Credit access: Smoother waters

Overall, credit access improved in October across all loan types but remained tighter compared with a year ago, according to the most recent Dealertrack Credit Availability Index. The index ticked up 0.7% sequentially to 97.8 in October but was down 5.7% YoY. Credit access remained 2.1% tighter than in February 2020.

Increased subprime share, tightened yield spreads and longer loan terms contributed to improved credit availability, but decreased approval rates and higher down payments worked against access, according to Cox Auto.

Approval rates in October fell 115 basis points (bps) sequentially and 120 bps YoY to their lowest level since November 2020, according to the index. At the same time, subprime share rose to 11.5%, up 40 bps month over month but down 50 bps YoY.

Subprime origination activity has slowed amid market challenges. In fact, two subprime auto lenders, American Car Center and U.S. Auto Sales, shuttered operations during the first half of 2023.

Additionally, subprime auto origination volume industrywide fell 14.9% YoY in Q2, according to the latest data from Transunion. By comparison, near prime and prime originations decreased 14.3% YoY and 13.2% YoY, respectively, in Q2. Super prime originations marked the only growth in Q2, with an uptick of 5.9% YoY.

Lower originations can be attributed to affordability woes, Satyan Merchant, senior vice president and automotive business leader at Transunion, told AFN. “Q2 of this year, we were just coming off peak used-vehicle prices. Since Q2, there’s been a steady decrease.”

“New-vehicle inventories are OK, and that trickles down to used cars. The signals looking forward are better when it comes to used prices.” — Satyan Merchant, SVP, President, Automotive Business Leader, Transunion

New-vehicle inventory increased 62% YoY to 2.4 million units, or a 67-day supply, as of Nov. 6, according to Cox Automotive. The last time new-car inventory surpassed a 60-day supply was in March 2021, according to Cox.

Used-vehicle prices have improved as new- and used-vehicle supply remains mixed. The Manheim Used-Vehicle Value Index dipped 2.3% sequentially and 4% YoY to 209.4 in October. Used-vehicle retail sales are estimated to be down 2% sequentially and 4% YoY in October, according to vAuto data. Used-vehicle retail inventory was estimated at a 49-day supply at the end of October, down one day sequentially and five days YoY.

Setback or opportunity?

The subprime market has been a struggle for some lenders but has presented opportunity for others. Subprime lender Credit Acceptance Corp. (CACC) has seen an uptick in loan originations and portfolio size, partly due to other lenders pulling back from the space, Chief Executive Ken Booth told AFN.

In the third quarter, Southfield, Mich.-based CACC tallied a 13% YoY rise in consumer loan assignments on a unit volume basis to 81,229 contracts. On a dollar basis, consumer loan assignments increased 10.5% YoY.

CACC expects to continue increasing originations and outstandings into 2024 as demand for its product remains high and the lender approves every application it receives, Booth said.

The lender has not adjusted how it scores consumers and has “roughly” maintained the same pricing it has in the past, he said, noting that it might lean slightly in favor of the lender compared to where it was before.

Buy here, pay here lender SameDay Auto is also taking an optimistic approach to the market as other lenders step back, Director of Servicing Armando Hildalgo said at Auto Finance Summit 2023 last month.

“There are so many people that are sitting out of the space; there are opportunities out there,” he said. “It’s just being careful of how we’re deploying our funds.”

Navigating with AI

But auto lenders must keep guardrails in place to ensure consumers aren’t put into loans and vehicles they cannot afford, Arivo’s Starr said.

“Dealerships are incentivized to move metal, to sell the car. Their skin in the game — as far as whether a consumer can make that payment — is minimal,” he said. “There’s a higher bar for lenders to make sure that we’re being responsible in helping consumers from [an affordability] standpoint.”

Arivo leverages AI and machine learning to predict consumers’ income and ability to pay at the point of application, Starr said. The lender’s model factors a potential borrower’s inflows of income and outflows of debt using alternative data to aid in proper decisioning, he said.

“We get submitted income and we’re able to compare that against … [the consumer’s] debt and other elements,” Starr said. “Gross income only tells half the story. To navigate these waters, discretionary income becomes a very important consideration for lenders.”

Consumers’ “ability to pay is their resilience, scrappiness and willingness to cut back on their budget — and add a side hustle when they need to,” Starr said.

Mirror, mirror

Subprime auto lenders’ balance sheet health mirrors that of the subprime consumer.

For much of 2023, auto financiers have been grappling with a volatile securities market and meteoric increases in the Federal Reserve’s benchmark interest rate, pushing up the cost of funds that they are unable to pass on to consumers.

“We’re not immune to inflation. Some of our costs are up and borrowing costs are up, so that puts pressure on us.” — Ken Booth, CEO, Credit Acceptance Corp.

“On the flip side, that puts more pressure a lot of the time on our competitors, and that’s partly why we’re growing very strongly as others are pulling back,” he said. “We tend to price with a higher margin of safety than our competitors. Sometimes, when liquidity is too easy to get, our product is less competitive.”

These higher borrowing costs are affecting lender activity in the auto asset-backed securities (ABS) market on which many subprime lenders heavily rely to fund loan production.

Nonprime ABS issuance volume as of Nov. 3 is lagging last year’s volume, sitting at $22.9 billion, down from $32.1 billion in the corresponding period a year ago, according to JPMorgan Securities. By comparison, nonprime ABS volume hit a record $43 billion in 2021.

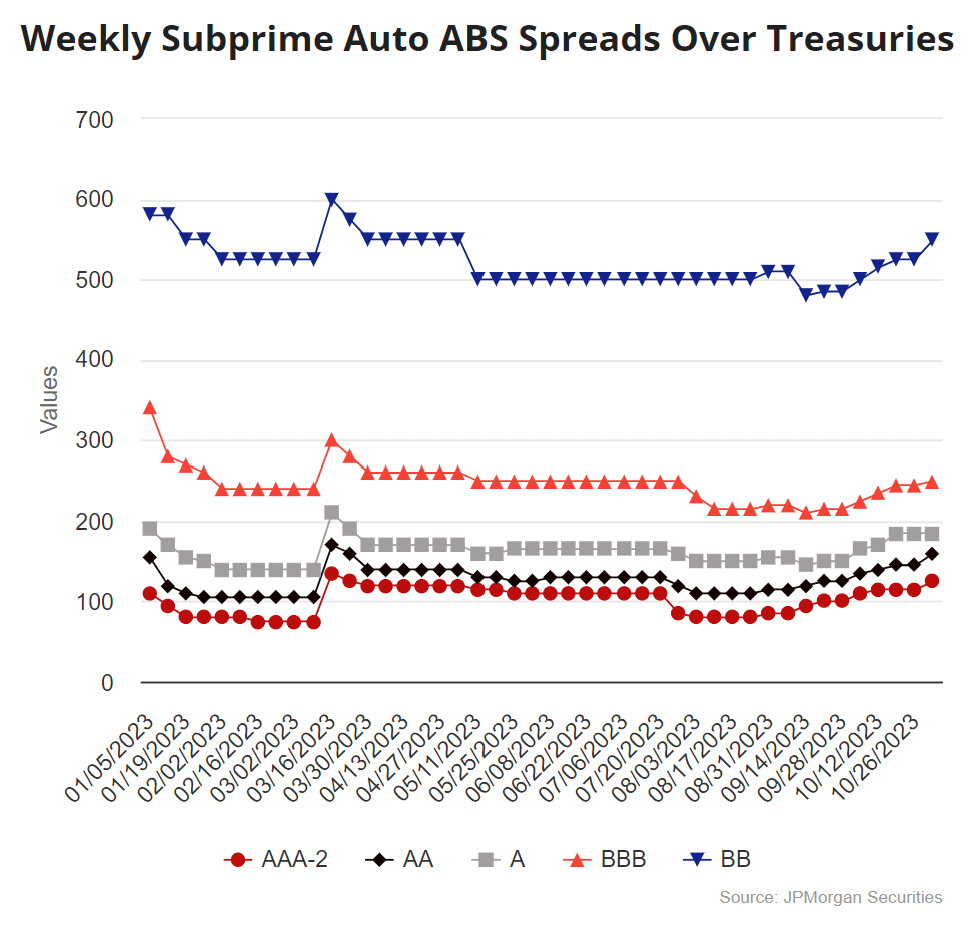

In addition, subprime ABS spreads have been ballooning and contracting for much of the year. As of Nov. 3, these spreads have widened to near the level seen at the peak during the week of March 16, around the time of Silicon Valley Bank’s collapse.

Spreads on AAA-2-rated bonds sat at 125 bps over treasuries, 10 bps below the March peak of 135 bps over treasuries. AA-rated bonds saw a similar widening, landing at 160 bps over treasuries, 10 bps below the peak.

ABS: Choppy waters

Despite the volatility, auto ABS remains a key source of funding for subprime lenders. CACC, for one, plans to continue to hit the auto ABS market as its main source of funding, Booth said. The subprime financier has issued $1.2 billion across three transactions this year, up from approximately $700 million in 2022 and flat with 2021 volume, according to Finsight, which monitors securities.

“The capital markets are choppier now than they were a couple of years ago. With borrowing costs going up too, it’s making things choppier,” Booth said, noting ABS “is a primary source of our funding.”

Moreover, pressures on consumers’ wallets are rippling through lenders’ portfolios. Industrywide, the subprime annualized default rate is creeping back toward 2019 levels, landing at 9.1% in September, according to Experian. Near-prime annualized default rates clocked in at 3.5%, the highest level in at least eight years.

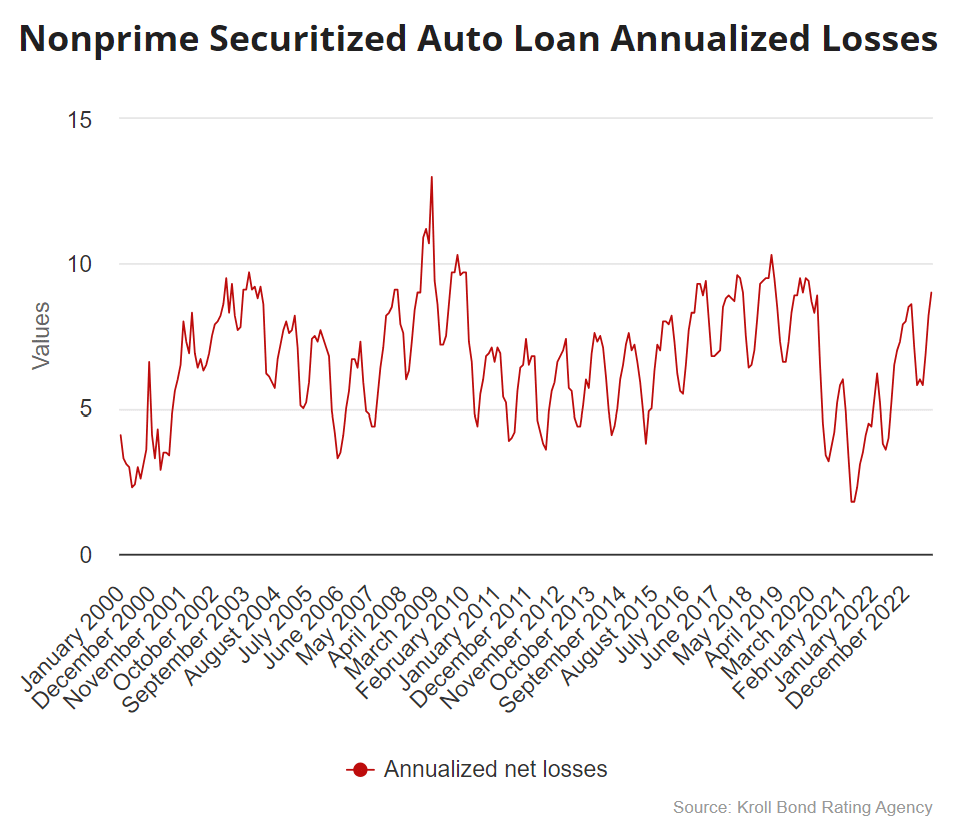

Those losses are surfacing in subprime ABS transactions, according to Kroll Bond Rating Agency (KBRA). Annualized net losses on the $68.5 billion in outstanding subprime collateral in the ABS market hit 9% during the August collection period, according to the rating agency. By comparison, annualized net losses peaked at 13% in during the January 2009 collection period across $25.8 billion of outstanding collateral.

Some subprime issuances are facing ratings downgrades because of increased cumulative net losses. In fact, nine of 11 classes of notes issued by defunct buy here, pay here lender U.S. Auto Sales across three issuances in 2020, 2021 and 2022 were downgraded due to a lack of credit enhancement when compared with revised loss projections, according to an Oct. 23 KBRA surveillance report.

Chadds Ford, Pa.-based subprime lender Flagship Credit Acceptance also had 11 classes of notes across six trusts placed on “credit watch negative” by S&P Global Ratings on Nov. 6. The credit rating agency also raised ratings on 20 different classes of notes and affirmed the ratings for 14 classes across 12 trusts on Nov. 13. KBRA also affirmed its ratings on 50 classes of notes and upgraded 14 classes of notes across 16 Flagship trusts on Nov. 9, according to the rating agency.

Securitized delinquencies surge

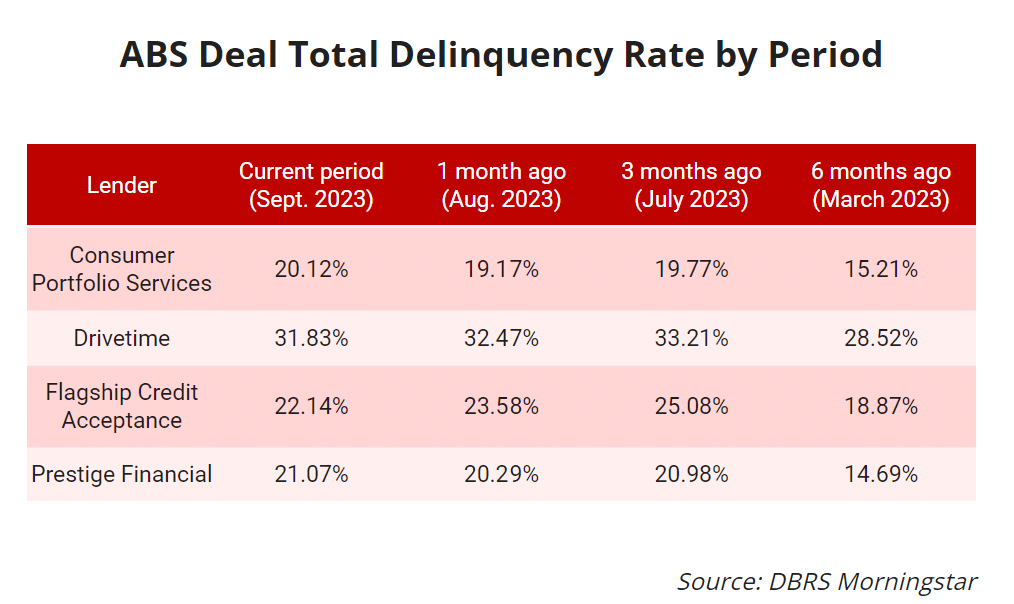

Delinquencies, too, have been rising over the past six months across auto loans originated prior to the pandemic as consumer credit deteriorates, according to credit rating agency DBRS Morningstar.

For example, Flagship logged a 327-bps increase in total delinquencies — which includes 30-plus, 60-plus and 90-plus days past due — as of September when compared with March to 22.14% in its fourth securitization of 2019, according to a DBRS monthly payment report.

Irvine, Calif.-based subprime lender Consumer Portfolio Services (CPS) saw a similar increase in its first transaction of 2020, with total delinquencies rising 491 bps as of September from March to 20.12%, according to DBRS.

A similar story has been playing out with other subprime auto issuers. Tempe, Ariz.-based Drivetime logged a 331-bps increase in total delinquencies as of September in its third securitization of 2019 to 31.83% when compared with performance data logged in March, and Draper, Utah-based Prestige Financial tallied a 618-bps increase in total delinquencies in September to 21.07% in its first securitization of 2019.

Drivetime and Prestige Financial did not respond to requests for comment by publication time.

2022 headwinds continue to chill

Loans originated in 2022 are proving to be a particular pain point for lenders, largely due to used-vehicle values spiking in January of that year and subsequently falling through the rest of the year. This pushed up loan-to-value ratios and put customers upside down on their auto loans.

Additionally, many subprime consumers were able to artificially increase their credit scores as the pandemic-era government stimulus, coupled with less opportunity to spend excess cash, enabled consumers to save more.

A shift in FICO scores due to pandemic stimulus and bolstered savings also contributed to performance discrepancies in 2022 vintages as lenders didn’t account for migration in FICO scores, CPS’ Lavin said.

“It affected the performance of 2022 portfolios. We missed that customer,” he said, adding that the lender later updated its scoring model to account for the shift.

CPS, for one, has seen loan performance worsen across 2022 vintages, President, Chief Operating Officer and Chief Legal Officer Mike Lavin said during Auto Finance Summit 2023.

The Irvine, Calif.-based lender’s auto loans 31 days or more past due jumped 246 bps YoY to 13.21% in Q3, while net charge-offs rose 193 bps YoY to 6.86%. CPS’ originations fell 31.1% YoY in Q3 to $322.4 million as the lender continued its credit-tightening actions. On the company’s Nov. 13 earnings call, Lavin said those actions included:

- Holding firm to its payment-to-income and debt-to-income ratios;

- Lowering its loan-to-value ratios;

- Putting increased emphasis on job stability and proof of residence requirements; and

- Making fewer exemptions.

“The subprime customer … is living paycheck to paycheck with not a lot of disposable income. [They’re] having a harder time parting with their money, even for their car.” – Mike Lavin, President, COO, Chief Legal Officer, Consumer Portfolio Services

“You’ve got lenders raising interest rates to chase our cost of funds, inflation costs … and you don’t have wages outpacing that,” Lavin said. “They just don’t have enough money to make their car payments. 2023 has shown some improvement but I don’t think we’re going to get there until 2024.”

Predicting defaults

Delinquencies are likely to worsen heading into next year before improving, Jim Murray, president of Western Funding, a subsidiary of Westlake Technology Holdings and part of the Nowlake Group, said at Auto Finance Summit 2023. “We didn’t hedge enough coming out of the pandemic,” he said, adding that the lender has since re-evaluated its scoring model.

Transunion data showed degradation in payment performance for Q4 2022 used-vehicle vintages compared with 2018 through 2020, Transunion’s Merchant said.

“That was a period when vehicle prices and inflation were high. That [was a] pinch point for consumers,” he said. “Inflation has come down through the course of this year.”

CACC has also seen “slight softening” in delinquencies in its 2021 and 2022 vintages, consistent with the industrywide trend, Booth said. The lender’s 2023 vintage, however, has been stable and is showing performance trends similar to 2019 and older vintages, he said.

Part of the problem is that some consumers are less likely to make their car payments due to the drop in vehicle values, Arivo’s Starr told AFN.

“People were buying vehicles that were priced high and then we were shocked as inventory concerns from COVID started resolving themselves,” he said. “These individuals are owing $30,000 on a vehicle that’s valued at $20,000. They have little incentive to continue to make payments. That’s one of the dynamics that surged delinquency in 2022.”

In response to worsening credit performance, auto lenders have improved their methods for predicting potential defaults.

SameDay Auto, for one, beefed up its default programs, Hidalgo said. “It’s training the portfolio to what your expectation is,” he said at the summit.

Arivo is using AI to monitor consumers’ ability to pay as delinquencies rise and updates its risk models quarterly Starr said at the summit.

“We can track what consumers are starting to get into hot water, [who] are starting to see their debt outflows exceeding their inflows, and we can be proactive from a collections management standpoint,” he said. “It’s not about squeezing payments out of consumers; it’s about being an advocate for them.”

CPS changed its charge-off timing to account for market conditions, Lavin said. The lender employed agents to call consumers who were either nearing delinquency or were 30 to 60 days past due on their auto loan and saw an improvement in the roll rate to later-stage delinquency as a result, he said. CPS also hired 92 additional collectors in 10 months.

“Delinquency is a good precursor to what could end up taking a charge off,” Lavin said. “For a customer that might be 11 days late … we used to just let them roll over and pray that they paid. But we put in a new strategy to [reach] those customers and give them help up front. Those could be customers that have a history of never being a potential [delinquency]. Given where we’re at, we’re going to get them healthy, even if it’s the first time they’ve ever been late.”

Western Funding, too, has emphasized “early-and-often” contact with consumers to improve collections, Murray said. “We also have the tool of extension, but it’s a limited tool that you can only use so far,” he said.

Flagship also “constantly” analyzes its programs and makes changes in response to credit cycle conditions, the spokesperson told AFN, adding that the lender has seen its weighted average consumer FICO score increase and has seen a dip in its payment-to-income ratio and debt-to-income ratio in 2023. Origination volume is expected to remain steady, the spokesperson said.

Regulators amplify pressure

As delinquencies increase, subprime auto lenders are also being forced to navigate a rise in consumer complaints and additional scrutiny on repossession practices from the Consumer Finance Protection Bureau (CFPB).

Complaints filed with the CFPB against subprime lenders were up 47.8% YoY to 3,637 as of Nov. 7, according to an AFN analysis of 12 lenders that issue on the ABS market. Most of the complaints focus on credit reporting and managing loans or leases.

Auto Finance CFPB Complaints

Source: Consumer Financial Protection Bureau

The increase in complaints comes as the CFPB has focused on auto finance in the past year, particularly on repossession practices and increased used-vehicle values, which the bureau said are pricing subprime consumers out of the market. The bureau built an auto finance dataset and ordered nine auto lenders in February to submit data from their portfolios.

Exeter Finance and Global Lending Services were among the subprime lenders ordered to submit portfolio data, according to information obtained by Auto Finance News through a Freedom of Information Act request. American Honda Finance Corp. Capital One Auto Finance, Chase Auto, GM Financial — which also lends in the subprime segment — Hyundai Capital America, PNC Bank and Regional Acceptance were the other auto lenders ordered to provide portfolio data.

A rightful repo?

Regulators remain focused on repossession procedures this year, Raymond Naples, in-house counsel at Santa Ana, Calif.-based subprime auto lender Veros Credit, said at Auto Finance Summit 2023.

“A lot of the repossession issues that I’ve been seeing generally relate to, ‘Are you putting out the proper notice?’” Naples said. “‘Are you consistent with whatever policy that you’ve implemented? And what’s the consistency with the repossession itself? Do you have people making that discretion? What are the exceptions? How do you control for that?’”

Consistency throughout the repossession process is also something state and federal regulators are keeping a close watch on, Husch Blackwell senior associate attorney Natalia Kruse said at the summit.

“Regulators are expecting servicers to be monitoring the vendor’s performance,” Kruse said. Specifically, lenders must monitor for situations in which a past-due borrower makes a payment after the repossession order has been issued, she said.

At Veros Credit, “what we’ve tried to do is integrate as many of our systems as we can so that they’re talking to each other [and] people are getting the necessary reports to try and minimize” lapses in communication, Naples said.

Watching for stability

If interest rates stabilize, lenders will be better able to predict monthly payments and rates they can offer, Transunion’s Merchant said.

“Lenders are looking forward to a period where interest rate activity will settle down, maybe even start to come down,” he said. “That could help vehicle originations and performance.”

Buy here, pay here lender SameDay is planning to grow while remaining cautious on approvals, Hidalgo said.

“We’re looking at technical [updates] …. [and] working with the dealers to communicate the programs that we have,” he said.

CPS is also being mindful when it comes to approvals. The lender’s acceptance rate has fallen to 51% compared with 72% in 2022 as demand remains the same, Lavin said.

Arivo, as a new company, plans to continue gaining market share into 2024. However, affordability concerns have made consumers reluctant to purchase new vehicles, Starr said.

“Across the industry, we’ve seen deteriorating demand for vehicles and the age of outstanding collateral creep up to all-time highs,” he said.

But 2024 represents an opportunity for growth for auto lenders who embrace subprime borrowers’ resilience while accounting for normalizing credit performance.

“We’re working through elevated delinquencies. As those are worked through our portfolios and there’s less of a cash draw from elevated losses and delinquencies, that’s going to be an opportunity to start opening the pipelines again.” — Landon Starr, Chief Risk and Information Officer, Arivo Acceptance