As we enter the second half of 2023, we continue to witness strong demand for auto loans accompanied by escalating attention from numerous disruptors and increased competition.

Meanwhile, interest rate hikes,increasing cost of funds, a shrinking market of subprime borrowers and an emerging wave of delinquencies are leading auto lenders to focus more on bottom-line profitability and the overall health of their loan portfolios.

What strategies and tools can help lenders maintain their competitive position while focusing on the bottom line?

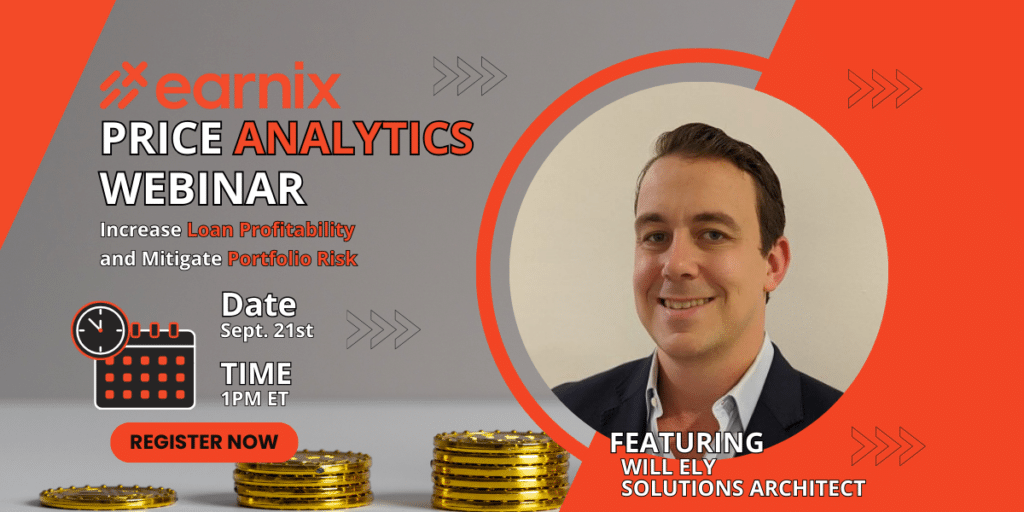

Join the Using Pricing Analytics to Increase Loan Profitability and Mitigate Portfolio Risk Webinar presented by Earnix, a global leader in pricing analytics and digital decisioning. This webinar is a unique opportunity to discuss the role of AI-backed analytics in increasing profitability of auto loans and mitigating risk.

Webinar attendees will learn how to:

- Find the sweet spot for auto loan pricing in a constantly changing market

- Use pricing to control portfolio risk profile

- Maintain the balance between volume, profitability, and competitiveness

- Utilize real-time pricing to drive revenue

Featured Speaker:

Will Ely, Solutions Architect at Earnix: A Global SME in pricing analytics, Will brings deep experience in advanced statistical modeling, machine learning, and cloud-based SaaS deployment. He has worked with some of the world’s largest financial institutions, helping them utilize pricing and product personalization to enhance revenue, growth, and customer experience.

Join us on September 21st and acquire knowledge from an industry thought leader who will guide you through the maze of today’s auto lending complexities. Don’t miss this chance to improve your lending strategies and portfolio performance.